Lebanon: resistance to IMF deal

23 August, 2023

After nearly two years of talks, Lebanon reached a tentative deal with the IMF in April 2022 for a $3 billion rescue package. But finalizing it is contingent on major financial restructuring and reforms to combat corruption and waste.

Economic experts and former officials involved in designing Lebanon’s original IMF-approved recovery plan in 2020 say the political leadership and associates in the banking sector are deliberately implementing a “shadow plan” to torpedo the deal and place the burden of bailing out the financial system on ordinary Lebanese who are already impoverished by the crisis.

The IMF plan would place much of the burden of backfilling the financial system’s losses on commercial bank shareholders, who include many prominent Lebanese political families and private sector associates. After extensive audits, many banks would have to sell assets or merge with others. Small depositors, meanwhile, would be able to recover most of their money.

Officials are banking on remittances from the diaspora that now make up almost 40% of the economy, while welcoming record numbers of tourists this summer. Tourists shell out hard cash in private beach clubs along the Mediterranean by day before flocking to nightclubs until sunrise.

[August 10 2023 OFAC sanctions Riad Salameh ]

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) is designating the former governor of Lebanon’s central bank, Riad Salameh. OFAC’s action is taken pursuant to Executive Order (E.O.) 13441, which authorizes sanctions against certain persons who have taken actions that have the purpose or effect of undermining Lebanon’s democratic processes. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior.

Salameh abused his position of power, likely in violation of Lebanese law, to enrich himself and his associates by funneling hundreds of millions of dollars through layered shell companies to invest in European real estate.

https://home.treasury.gov/news/press-releases/jy1687

[May 26 2023 Arrest warrent for Riad Salameh ]

Lebanese central bank governor Riad Salameh is spending his final weeks in office a wanted man, faced with French and German arrest warrants that have been prompted by long-running corruption probes.

[May 16 2023 ]

A French investigating magistrate today issues an international arrest warrant for Lebanon’s central bank chief Riad Salameh, a source close to the case says.

Salameh earlier failed to appear for questioning by French investigators who want to know how he amassed sizable assets across Europe, his lawyer says.

During a visit to Lebanon in March, a European delegation questioned Salameh about the Lebanese central bank’s assets and investments outside the country, a Paris apartment that the governor owns and his brother Raja Salameh’s brokerage firm Forry Associates Ltd.

Forry is a British Virgin Islands-registered company that listed Salameh’s brother as its beneficiary.

It is suspected of having brokered Lebanese treasury bonds and eurobonds at a commission, which was then allegedly transferred to bank accounts abroad.

[2017 FBME formerly known as the Federal Bank of the Middle East gets hacked ]

.https://img.buzzfeed.com/buzzfeed-static/static/2017-12/12/9/asset/buzzfeed-prod-fastlane-01/sub-buzz-32587-1513088126-1.jpg)

.https://img.buzzfeed.com/buzzfeed-static/static/2017-12/12/9/asset/buzzfeed-prod-fastlane-01/sub-buzz-32587-1513088126-1.jpg)

.https://img.buzzfeed.com/buzzfeed-static/static/2017-12/12/9/asset/buzzfeed-prod-fastlane-01/sub-buzz-32587-1513088126-1.jpg)

.https://img.buzzfeed.com/buzzfeed-static/static/2017-12/12/9/asset/buzzfeed-prod-fastlane-01/sub-buzz-32587-1513088126-1.jpg)

.https://img.buzzfeed.com/buzzfeed-static/static/2017-12/12/9/asset/buzzfeed-prod-fastlane-01/sub-buzz-32587-1513088126-1.jpg)

.https://img.buzzfeed.com/buzzfeed-static/static/2017-12/12/9/asset/buzzfeed-prod-fastlane-01/sub-buzz-32587-1513088126-1.jpg)

December 13, 2017, at 2:00 a.m. FBME formerly known as the Federal Bank of the Middle East, has been investigated for years by the US Financial Crimes Enforcement Network (known as FinCEN). Buzzfeed now has documents showing “how FBME executives scrambled to lie, threaten, use forgery, and shred their way to success while Quinn Emanuel and Hogan Lovells did battle on the bank’s behalf and accountants at KPMG and Ernst & Young overlooked glaring red flags as they gave a corrupt institution their gold-plated seal of approval.” In the coming days, we will expose a secret network of Moscow-based slush funds linked to the Russian government, Syrian chemical weapons, and ISIS – and reveal how an international banking giant allowed suspicious money to flood the Western financial system by facilitating FBME’s dollar transactions for decades.

[October 24 Vijay Millya:shell companies in seven countries ]

Vijay Mallya fled to Britain in March 2016 after being pursued for recovery of Rs 9,091 crore [1388757210.45 usd] owed to a consortium of 17 Indian banks by his now defunct Kingfisher Airlines. Former liquor baron is accused of transferring a huge chunk of Rs 6,027-crore [920695160.86 usd] loan he took for his now-defunct Kingfisher Airlines to shell companies in seven countries the United Arab Emirates (UAE), the US, France, Singapore, Ireland and Mauritius and South Africa.

Mallya left India in 2016, saying he was moving to England to be closer to his children. He has since refused to return to India and said he fears an unfair trial amid the “media frenzy and hysteria” over unpaid dues. Mallya has also said government agencies are pursuing a “heavily biased investigation” and holding him guilty without trial.Officials, have found 30 antique objects, including idols dating to the 10th century and paintings. Of these, a majority were from south India and had been sold by Kapoor’s gallery ‘Art of the Past’ between 2007 and 2012 to Singapore.

June 16 2015 Subhash Kapoor,smuggled objects found in Singapore ]

“When we examined the two antiquities, it was confirmed that it was goddess Uma Maheshwari idol from south India and a Christian Altar belonging to a church in Goa. While the age of the idol is between 9th and 10th century, the Altar dates back to 18th century,” the antiquity wing of the ASI team that travelled to Singapore between May 12 and 15 following a communication from the Asian Civilisation Museum

[April 16 Subhash Kapoor, a dealer in the largest antiquities smuggling operation on American soil]

Authorities in New York have sought custody of the largest seizure of antiquities in American history — 2,622 artifacts worth $108 million looted from India and other places in south Asia – smuggled into US by Madison Avenue art dealer Subhash Kapoor. The seized items included bronze and stone statues of Hindu deities, many of them ancient masterworks worth several million dollars each. Kapoor is currently awaiting trial in India on charges of plundering archaeological sites and conspiring with black market traders to send illicit artifacts overseas. The cache includes several major Cambodian artifacts, including a $1.2-million Naga statue found in Mr. Kapoor’s Art of the Past gallery .There is also a group of Cambodian stone figures worth $700,000; two objects identified as “Khmer statues” worth $250,000 and $175,000; a Cambodian “standing figure on pedestal” also worth $175,000; an “elephant w/hat statue” worth $14

5,000; a “Khmer Vishnu sandstone wall fragment” worth $65,000; and a crowned Buddha worth $45,000; as well as many other Cambodian statues worth tens of thousands of dollars.

[A

pril 8]

is awaiting trial in India

“He certainly conned a lot of people,” Mr. Kennedy said of Subhash Kapoor, a dealer identified by authorities as having once run the largest antiquities smuggling operation on American soil., who is awaiting trial in India on charges of trafficking in $100 million worth of stolen artifacts. Mr. Kapoor, 65, has pleaded not guilty. Brenton M. Easter, the special agent in charge of Operation Hidden Idol for Immigration and Customs Enforcement, said museums should understand that the investigation was continuing. “Just because they haven’t been contacted yet doesn’t mean they should not anticipate being contacted down the road,” he said.

The federal investigation, Operation Hidden Idol, began in 2012 with raids on Mr. Kapoor’s gallery and on several warehouses and other locations where he stored Indian antiquities. Officials with Immigration and Customs Enforcement and Homeland Security Investigations, which are jointly directing the investigation, said they had seized tens of millions of dollars worth of objects that they believed were looted from ancient temples in India.

In addition, the Manhattan district attorney’s office, working with the investigators, has prosecuted Mr. Kapoor’s sister; a woman identified as his girlfriend; and the longtime manager of his gallery on charges related to the artifacts. The manager, Aaron Freedman, pleaded guilty in December 2013 to six criminal charges and is said to be cooperating with the authorities.

On October 7, 2013, the Manhattan District Attorney filed a criminal complaint against Kapoor’s sister, 60-year-old Sushma Sareen, alleging that, while her brother was in jail, she and Kapoor’s daughter, Mamta Sager, in connivance with former Art of the Past employee, Aaron M Freedman, played a cat-and-mouse game with authorities, moving a set of stolen idols from a safe house in Manhattan to Sareen’s house in a nearby Long Island suburb. Sareen, who has retained rapper 50 Cent’s lawyer, Scott Leemon, declined to comment. She is expected to go before a Grand Jury in early January, who will decide whether or not to file formal charges.

Salina Mohamed

Three of the objects cited the previous owner as Salina Mohamed, Kapoor’s longtime girlfriend. In December, Mohamed was charged with four counts of criminal possession of stolen property and one count of conspiracy. Prosecutors say she was involved in the fabrication of fake ownership histories for Kapoor’s stolen objects.

Paramaspry Punusamy

One object reportedly came from another of Kapoor’s ex-girlfriends, Paramaspry Punusamy, the owner of Dalhousie Enterprises and Jazmin Asian Arts in Singapore. Punsamy is reported to have triggered the Kapoor investigation after falling out with him over a lawsuit in 2009.

[April 2 $500K sales part of much larger art crime investigation]

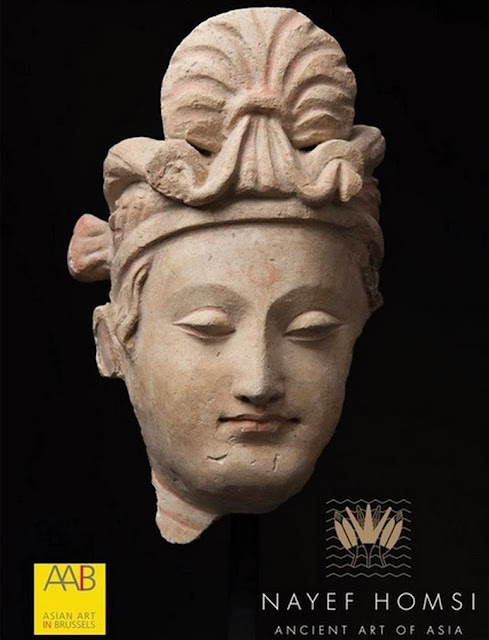

Homsi, who lives in Greenpoint, has an Upper East Side gallery that was featured in the New York Times last month in a roundup of Asia Week exhibits.

Nayef Homsi is suspected of selling three sculptures of Hindu and Buddhist deities — despite knowing the artifacts were stolen. Nayef Homsi is said to be a “minor player” in a much larger investigation.

New York County District Attorney’s office intends to arrest Homsi. The DA’s office, which partnered with the Department of Homeland Security on the investigation, filed the papers in Manhattan Civil Supreme Court on March 25, asking a judge to freeze a bank account held in the name of Homsi’s company, Maitreya, where the proceeds of the illegal sales had been deposited.

[March 14 $20 million mark-up yields art fraud arrests; ” big dealers and collectors involved”]

Yves Bouvier, the Swiss businessman and art dealer who operates giant storage centers in Switzerland, Luxembourg and Singapore that hold billions of dollars of art for the global rich. Bouvier was arrested in Monaco in February as part of an investigation into fraud. The case focuses on several works purchased by Russian billionaire Dmitry Rybolovlev, who claims Bouvier inflated or misrepresented prices by millions of dollars. one of the pieces was an Amadeo Modigliani sold by hedge-fund billionaire Steve Cohen. Rybolovlev bought the piece from Bouvier acting as the dealer for $118 million. Rybolovlev later talked to Cohen’s art adviser, Sandy Heller, and found Cohen sold the Modigliani to Bouvier for $93.5 million—giving Bouvier a more than $20 million mark-up, including fees

Bouvier is accused of fraud and complicity with money laundering along with an accomplice, Tania Rappo, and a third person who hasn’t been immediately identified according to Monaco General Prosecutor Jean-Pierre Dreno. On March 12, a Singapore court ordered a freeze on Bouvier’s assets, forbidding him from removing any assets or disposing of any assets outside of Singapore, according to local media reports. “This is just the beginning,” said one prominent art lawyer in New York who asked not to be named. “There will be a lot of big dealers and collectors involved.”

[January 30 Hillel “Helly” Nahmad and Modigliani’s 1918 portrait]

INDEX NO. 650646/2014

NYSCEF DOC. NO. 237 RECEIVED NYSCEF: 01/21/2015

Philippe Maestracci v. Helly Nahmad Gallery

JUSTICE: Eileen Bransten

INDEX NO: 650646_2014

DEFENDANT’S LAW FIRM: Aaron Richard Golub

CAUSE OF ACTION: Declaration of Title – plaintiff is rightful owner of painting, Conversion, Replevin

LATEST EVENT: In action for recovery by former owner of Modigliani painting, defendant moves for sanctions and to strike “scandalous and prejudicial” ad hominem attacks on defendants and counsel[November 9 2014

An Amedeo Modigliani seized by the Nazis, worth as much as $25 million is being held in a warehouse in Switzerland by a corporation controlled, allegedly, by the Nahmad family. Helly Nahmad, who is serving a year in prison, was sentenced in April after pleading guilty to operating a sports-gambling business that booked millions of dollars in bets. The International Art Center is registered in Panama and has an office in Switzerland, where it holds artworks at the Geneva Freeport. The painting in question, Modigliani’s 1918 portrait, “Seated Man With a Cane,” is in that warehouse. A man named Van der Klip, bought the Modigliani in a forced sale in 1947. The painting had then been resold twice in quick succession, ending up in the possession of a U.S. officer, whose name and address were unknown. That painting , in a 1996 Christie’s auction in London, was purchased for $3.2 million by the International Art Center.

Mr. Maestracci, the sole heir to the painting, and his attorneys have described the International Art Center as a shell company used by the Nahmad family to hold a multi-billion-dollar art collection, is asking for depositions. The Helly Nahmad Gallery, in a court filing, said it “lacks any interest whatsoever in this controversy and lacks any authority or capacity to remedy any injury allegedly suffered” by Mr. Maestracci.[May 1 Helly gets FCI Otisville – It’s a walled Shangri-la.]

FCI Otisville NY

Hillel “Helly” Nahmad, who had apartments at Manhattan’s Trump Tower, a model for a girlfriend and an art gallery that featured modern masters such as Pablo Picasso, was sentenced to a year and a day in prison for his role in a high-stakes gambling ring. The gallery will remain open while his client serves his term. As part of his plea, he agreed to forfeit $6.4 million and all rights to the Dufy painting titled “Carnaval a Nice, 1937.” The judge yesterday ordered him to also pay a $30,000 fine and said he had to surrender to U.S. prison officials on or by June 16. Furman granted Brafman’s request that he would recommend Nahmad serve his time at the Federal Correctional Institution at Otisville, New York.

White-collar criminals and crooked pols are banging down the door to get into Otisville federal prison. The reason? It’s a walled Shangri-la.

“You could do about anything you wanted there,” said former inmate John Altman. “It’s not just good. It’s sweet. That’s why you request to go there.”

The prison’s store doubles as a delicatessen, serving up such favorites as rib steak, gefilte fish, kugel, salmon, chorizo and smoked oysters.

It’s only a 90-minute drive for visitors from the city, and it has boccie courts, horseshoe pits and enough room to play soccer. Convicts could stay up until 2 a.m. on Friday and Saturday nights watching HBO, Showtime and Cinemax.

The low-security camp that’s connected with Otisville’s 1,200-inmate medium-security complex is exclusive too, housing only about 125 felons, two to a cell.

Memorial Day and the Fourth of July are celebrated with cookouts serving hamburgers, hot dogs, watermelon and potato salad.

“The food is right. The commissary is right. The officers don’t bother you. There are a lot of courses you can take. You had weights inside and outside, free weights and machines,” Altman said.

“Food, activities, TV and movies, and visitations are the four things you judge a facility by,” he said. “Things were good.”Vadim Trincher was sentenced yesterday to five years in prison by Furman. The other ring was run by Trincher’s son, Illya Trincher of Beverly Hills, California, and was a high-stakes gambling operation for millionaires and billionaires, according to the government. He pleaded guilty to gambling charges in November and is scheduled to be sentenced in May.

[January 22]

Playing poker isn’t a crime, but it’s illegal to profit by promoting it.

Edwin Ting was sentenced January 21 in Manhattan federal court to five months in prison and ordered to forfeit $2 million.

U.S. Attorney Preet Bharara says that from 2010 through 2013, Ting ran poker games with pots that reached hundreds of thousands of dollars.

Authorities say players in the underground network included professional athletes, Hollywood luminaries and business executives.

Playing poker isn’t a crime, but it’s illegal to profit by promoting it.

[January 21]

prominent online poker pro Justin Smith

Another case under the ‘U.S. v. Alimzhan Tokhtakhounov’ can be shelved.

The prosecution of prominent online poker pro Justin Smith for his minor role in a large New York City-based sportsbetting and gambling ring with ties to alleged Russian mobsters has concluded with Smith receiving extended probation, including home monitoring and community service.

In the sentencing hearing on January 20 for Smith, well known as “BoostedJ” in the poker community, presiding judge Jesse M. Furman sentenced Smith to two years probation, but with the special condition of an initial three-month period of home confinement, typically but not necessarily monitored by electronic ankle bracelet. Smith was also ordered to perform 200 hours of community service following the completion of his home confinement term. Smith had previously agreed to pay a fine of $500,000 as part of his sentencing. It is believed Smith will serve his home confinement in his LA-area residence.

Smith’s sentence also includes a couple of very typical added conditions, such as a prohibition on firearms and submission for DNA testing, and represents a slight down tick from what had been requested by the office of lead SDNY Preet Bharara, which had sought a sentence of six to 12 months. Smith may have posted a cryptic Twitter comment referring to the probation he received when he wrote, on Wednesday, “Was granted the birthday wish I was hoping for.”

According to the case’s sentencing memorandum, Smith assisted with the online sportsbetting operation by creating numerous online accounts for the ring’s leaders, including Illya Trincher and Hillel “Helly” Nehmad, including several at the now-defunct HMS Sports, along with one or more at PinnacleSports. Smith moved six-figure sums for both sportsbetting and poker through several of these accounts. The memorandum, which includes redacted but length conversations obtained by wiretap, includes mention of an account owned by fellow defendant and poker pro Abe Mosseri that was also used by Smith, plus a so-called “Mexican account” that was operated jointly by Smith and Illya Trincher.

The judgment is one of the first in the extended case of U.S. v Tokhtakhounov et al, in which 34 defendants were charged with various roles in the operation of a prominent sportsbetting and gambling ring. Prominent members included at-large, indicted Russian arms dealer Alimzhan “Taiwanchik” Tokhtakhounov, former WPT event winner Vadim Trincher and prominent New York art dealer Nehmad. All told, the ring is alleged to have laundered tens of millions of dollars in gambling proceeds through its live and online operations.

Smith was charged with three relatively small offenses as one of the case’s 34 defendants, originally facing charges of participating in an illegal sports gambling business, the transmission of sports wagering information (a Wire Act violation), and the acceptance of a financial instrument for unlawful internet gambling. Smith, who allegedly acepted and placed bets on behalf of his friends and himself through online sites maintained by the gambling ring’s bosses, eventually pled guilty to a single count, the illegal sports gambling business charge, with the other two counts being dismissed.

Smith was believed to have cooperated with authorities following his April 2013 arrest and reached an agreement with prosecutors in August, entering a formal guilty plea soon after. BoostedJ becomes the first of the case’s ten or so defendants with prominent poker connections to be formally sentenced, and his term may be an indicator of what likely awaits co-defendants such as fellow poker pros Bill Edler and Peter “Nordberg” Feldman, who were charged with the same three sportsbetting counts. Neither Edler nor Feldman has yet to agree to a plea deal with DOJ Southern District of New York prosecutors.

Smith, a prominent cash-game pro who has also notched over $2.1 million in career tournament earnings, is one of 24 defendants in the case who have reached deals to date. Another of the early-pleading defendants, Edwin Ting, was also scheduled for a sentencing hearing this week. Ting’s hearing, however, was pushed back to January 21st due to a scheduling conflict with the SDNY prosecutor dealing specifically with Ting’s case and charges.

[August 13, 2013]

William Barbalat, 42, admitted to hosting illegal underground poker games in his apartment, as well as helping facilitate wire transfers to players in different states. Barbalat is one of nearly three dozen individuals charged in the matter.The move will spare Barbalat from a potential sentence of 10 years in prison. His deal reportedly will likely result in him spending six months to a year behind bars.

He will be sentenced in December.

[August 13]

Alimzhan Tokhtakhounov

The indictment defines two related gambling rings.

The “Taiwanchik-Trincher” organization, led primarily by Trincher, Anatoly “Tony” Golubchik and Alimzhan “Taiwanchik” Tokhtakhounov, allegedly held underground poker games for professional players, celebrities and Wall Street financiers, shaking down those reluctant to pay their losses and laundering the rake through shell companies in the US and Cyprus. Through gambling websites operating illegally in the United States, the ring also ran a high-stakes sports betting business that catered to Russian and Ukrainian oligarchs. A thief in law (Russian: вор в законе vor v zakonye; Ukrainian: злодій у законі zlodiy u zakoni; Belarusian: злодзей у законе zlodzey u zakone; Georgian: კანონიერი ქურდი kanonieri kurdi; Armenian: օրենքով գող orenk’ov goğ; Azerbaijani: Qanuni oğru) is a career criminal who is respected, has informal authority and an elite status within the organized crime environment in the Soviet Union, and currently in the post-Soviet states and respective diasporas abroad. Estimates concerning the number of “Vory” throughout the world range from several hundred to over 10,000. Thieves in law are drawn from many nationalities from a number of post-Soviet states

Meanwhile, the related “Nahmad-Trincher” organization, directed primarily by Hillel “Helly” Nahmad, Noah “The Oracle” Siegel and Illya Trincher, reportedly ran a similar high-stakes gambling operation in New York and Los Angeles. The operation took in tens of millions in bets on illegal websites, then laundered profits through a multitude of US bank accounts, a plumbing company in the Bronx, a real estate company and car repair shop in New York City, and a firm that sells used cars over the Internet.

At least 30 of the 34 people named in the indictment were in custody as of April, and the trial is planned to start in June, 2014. The key missing figure who has remained out of reach is the Russian thief-in-law Tokhtakhounov, an ethnic Uigur known as “Taiwanchik” for his Asian features. ALIMZHAN TOKHTAKHOUNOV, a/k/a “Taiwanchik,” a/k/a “Alik,” VADIM TRINCHER, a/k/a “Dima,” ANATOLY GOLUBCHIK, a/k/a “Tony,” MICHAEL SALL, STAN GREENBERG, a/k/a “Slava,” ILLYA TRINCHER, HILLEL NAHMAD, a/k/a “Helly,” JOHN HANSON, NOAH SIEGEL, a/k/a “The Oracle,” JONATHAN HIRSCH, ARTHUR AZEN, DONALD MCCALMONT, DMITRY DRUZHINSKY, a/k/a “Dima,” a/k/a “Blondie,” ALEXANDER ZAVERUKHA, a/k/a “Sasha,” ALEXANDER KATCHALOFF, a/k/a “Murushka,” ANATOLY SHTEYNGROB, a/k/a “Tony,” ILYA ROZENFELD, PETER SKYLLAS, RONALD UY, NICHOLAS HIRSCH, BRYAN ZURIFF, MOSHE ORATZ, KIRILL RAPOPORT, DAVID AARON, a/k/a “D.A.,” JUSTIN SMITH, ABRAHAM MOSSERI, WILLIAM EDLER, PETER FELDMAN, EUGENE TRINCHER, EDWIN TING, a/k/a “Eddie,” MOLLY BLOOM, WILLIAM BARBALAT, YUGESHWAR RAJKUMAR, a/k/a “Mateo Hermatte,” and JOSEPH MANCUSO, a/k/a “Joe the Hammer,” here

Interpol has a red notice out on Tokhtakhounov, who was previously indicted for bribing ice skating judges at the 2002 Winter Olympics. Tokhtakhounov lives in Russia and has been on the Forbes list of the world’s 10 Most Wanted fugitives since it was first compiled in 2008.

In a televised interview with the channel Mir 24 after the April indictment, Tokhtakhounov said the case against him was “made up,” calling it “yet another fairy tale from the Americans.”

The main players include a notorious Russian thief-in-law (the equivalent of an Italian mafia don), a billionaire art mogul, a J.P. Morgan banker, a Hollywood poker hostess and the Russian-born ringleader — poker pro Vadim Trincher, who lived in Trump Tower in a $5 million apartment directly beneath that of “The Donald” himself.

“From his apartment he oversaw what must have been the world’s largest sports book,” Assistant US Attorney Harris Fischman said during a hearing at which a judge ordered Trincher, facing nearly a century behind bars if convicted, held for trial without bail.

The whopping 84-page federal indictment spells out how the conspirators all fit into two related rings that operated since at least 2006 out of Kyiv, Los Angeles, Moscow and New York.here’s a look at the 34 individuals indicted:

Alimzhan Tokhtakhounov Vadim Trincher Anatoly Golubchik Michael Sall Stan Greenberg Illya Trincher Hillell Nahmad John Hanson Noah Siegel Jonathan Hirsch Arthur Azen Donald McCalmont Dmitry Druzhinsky Alexander Zaverukha Alexander Katchaloff Anatoly Shteyngrob Ilya Rozenfeld Peter Skyllas Ronald Uy Nicholas Hirsh Bryan Zuriff Moshe Oratz Kirill Rapoport David Aaron Justin Smith Abraham Mosseri William Edler Peter Feldman Eugene Trincher Edwin Ting Molly Bloom William Barbalat Yugeswar Rajkumar Joseph Mancuso

Feds bust high-stakes poker and sportsbooking ring

[April 27]

Marc Lasry and Sonia Gardner

Marc Lasry,employed the Clintons’ daughter, Chelsea, between 2006 and 2009, Three years after getting her M.A., she joined Avenue, which was started in 1995 by Lasry [JD New York Lw School] and his sister, Ms.Sonia Gardner [JD from Cardozo, Yeshiva U.], Previous Name: Sonia Esther Lasry, and has about $12.5 billion in assets and specializes in distressed debt. Chelsea Clinton says she left her career on Wall Street three years ago to find more purpose.

“Intellectually, I loved my job, but I didn’t get any meaning from it,” says Clinton, 33, who worked from 2006 to 2009 as an associate at Avenue Capital Group LLC, a New York- based hedge fund firm. “I didn’t fundamentally become re- motivated every day in the way that I do now.” Lasry has five children, one of whom now works in the White House. He lives at 4 East 74th Street.

New York’s chief federal prosecutor charged 34 people in an alleged $100 million Russian-run poker money laundering operation.

Among those charged were Illya Trincher, the son of a professional poker player, who is accused of running the ring for multi-millionaire gamblers with Helly Nahmad, an elite Manhattan art dealer based in the Carlyle hotel.

Others arrested included Molly Bloom, the so-called “poker princess” who has organised games for celebrities such as Leonardo DiCaprio and Tobey Maguire.

Mr Lasry has played poker with some of the accused, including Mr Trincher, but it was a “complete surprise to him that they are accused of violating the law”, said a source close to the financier.

He said: “I am very grateful to have been considered, but I would like to put the speculation to rest and let you know that I will be remaining at Avenue.” The source familiar with his decision said that he was remaining at Avenue as it had become clear that he would divest his financial holdings in Avenue and its funds. “It has nothing to do with this poker investigation,” he said.

The Moroccan-born financier, 53, is known in Wall Street circles as a “master of the universe” type – the phrase coined by novelist Tom Wolfe to describe powerful New York finance industry high-flyers.

Chelsea Clinton and her husband, Marc Mezvinsky, are in contract for a four-bedroom condominium near Manhattan’s Madison Square Park that was listed at $10.5 million, a person with knowledge of the building said.

The couple agreed to purchase a 5,000-square-foot (465- square-meter) apartment on the fourth floor of the Whitman on East 26th Street.

Filed in Uncategorized

Tags: " a/k/a "Alik, " a/k/a "Blondie, " ALEXANDER KATCHALOFF, " ALEXANDER ZAVERUKHA, " ANATOLY GOLUBCHIK, " ANATOLY SHTEYNGROB, " and JOSEPH MANCUSO, " ILYA ROZENFELD, " JOHN HANSON, " JONATHAN HIRSCH, " JUSTIN SMITH, " MICHAEL SALL, " MOLLY BLOOM, " VADIM TRINCHER, a/k/a "D.A., a/k/a "Dima, a/k/a "Eddie, a/k/a "Helly, a/k/a "Joe the Hammer, a/k/a "Mateo Hermatte, a/k/a "Murushka, a/k/a "Sasha, a/k/a "Slava, a/k/a "Taiwanchik, a/k/a "The Oracle, a/k/a "Tony, ABRAHAM MOSSERI, Alimzhan Tokhtakhounov, Anatoly “Tony” Golubchik, ARTHUR AZEN, BRYAN ZURIFF, chelsea clinton, cyprus, DAVID AARON, DMITRY DRUZHINSKY, DONALD MCCALMONT, EDWIN TING, EUGENE TRINCHER, FBME, FBME formerly known as the Federal Bank of the Middle East, Google, Hillel “Helly” Nahmad, HILLEL NAHMAD, Illya Trincher, International Art Center, kapoor cache seized, KIRILL RAPOPORT, Marc Lasry, Modigliani, MOSHE ORATZ, Nayef Homsi, NICHOLAS HIRSCH, Noah, Noah “The Oracle” Siegel, NOAH SIEGEL, PETER FELDMAN, PETER SKYLLAS, Philippe Maestracci, poker, RONALD UY, Sandy Heller, Singapore, Sonia Gardner, STAN GREENBERG, Steve Cohen, Subhash Kapoor, thief in law, WILLIAM BARBALAT, WILLIAM EDLER, YUGESHWAR RAJKUMAR