Few consultants have benefited as much from illegal stock deals as Hanno Berger. The Wiesbaden district court has now sentenced the tax attorney to eight years and three months in prison for serious tax evasion. He was not the inventor of the group share transactions. But by opening up the lucrative share trade for very wealthy investors, Berger is considered by the Bonn Criminal Court to be the midwife of “Cum-ex 2.0”. From April 2022, Berger was on trial in Bonn for tax evasion in connection with share transactions by the private bank MM Warburg, and the proceedings in Wiesbaden began about a year ago.

March 28 2023 France raids banks ]

A spokesperson for France’s Financial Prosecutor’s Office (PNF) said the raids, which began at 9:30 a.m. and were still ongoing at midday, targeted four French banks and one international bank on suspicion of money laundering and fiscal fraud.

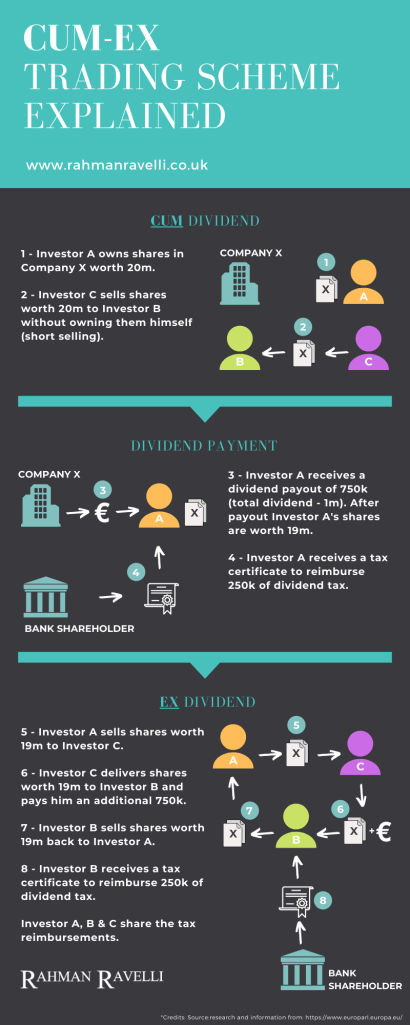

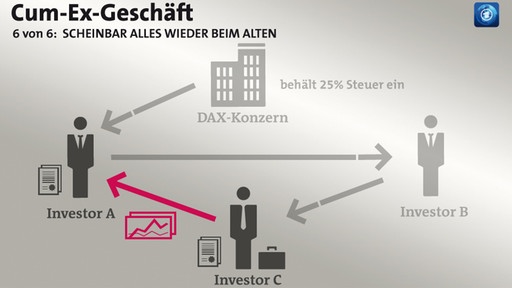

PNF representatives said the investigations are linked to legally dubious “cum cum” practices in which banks create overly complex legal structures as a way to allow wealthy clients to skip out on tax liabilities for dividends. Cum-ex is Latin for “with-without,” describing the nature of miraculously disappearing dividends,. banks, stock traders and lawyers had successfully managed to split dividends in such a way as to avoid as much as $62.9 billion in taxes across Europe, with Germany (ca. $36.2 billion) and France (ca. $17 billion) being by far the biggest victims.

The banks being investigated are: Societe Generale , BNP Paribas, Exane, Natixis and HSBC.

[February 26 2022 German banks: cum-ex planner Hanno Berger extradited ]

Hanno Berger, 71, was handed over to German police officials in the city of Konstanz in southern Germany, prosecutors based in Frankfurt said.

The German states of Hesse and North Rhine-Westphalia both sought his extradition. Berger was to appear immediately before a district court in Wiesbaden, the capital of Hesse, near Frankfurt, for a custody order.

Berger has been accused of being one of the main architects of a multibillion-euro tax fraud scheme that operated from 2005 until 2012.

Hanno Berger, the central suspect in the investigation, now lives in exile in the Swiss Alps. He advised the Australian bank Macquarie, another caught up in the scandal, on cum-ex trading but claims he was not paid for it. He says the scheme was based on a legitimate legal loophole. “They (the German state) cannot punish others for their mistakes,” he said.

[December 29 2021 arrangements ]

Germany is investigating more than a thousand suspects as part of the Cum-Ex probe and German prosecutors have already secured the convictions of three former bankers. More than two dozen traders, bankers and lawyers have been charged in the scandal and three trials are currently underway.

[February 9 2021 Red notice ]

Interpol issued a “red notice” alert on Tuesday to locate Paul Robert Mora, a former trader with Munich-based bank HBV who is wanted by German prosecutors in a tax fraud case.

Mora’s case is part of an investigation into so-called cum-ex scheme in which participants lent each other shares to collect reimbursement for taxes they hadn’t paid. Many of those accused of illegally gaining from the tax rebates say they only exploited a “legal” loophole to pay less taxes.

[January 17 2020 $63.4 billion saved or tax evaded? €2.4bn recovered ]

The German Finance Ministry is investigating 500 cum-ex arrangements to the value of some €5.5bn. Some €2.4bn has already been recovered. Cum-ex trades involved bankers, lawyers and traders all across Europe.

It is believed that around 100 banks are being investigated by the German authorities, including big names such as Bank of New York Mellon, Deutsche Bank AG, and Societe Generale SA.

[ September 4 2019 ]

The two British citizens, Martin Shields, 41, and Nicholas Diable, 38, are accused of having defrauded the German state of €447.5m (£405m) from London’s banking district with so-called cum-ex trading schemes. The trial, which is scheduled to last until January next year, is being followed with great interest across Europe because many more investment bankers, working for clients including Deutsche Bank, Barclays and Sweden’s SEB, are suspected to have practised cum-ex deals between 2001 and 2012, when legislators closed the loopholes that made the practice possible.

[Novmber 2018]

At least 10 other European countries beyond Germany have been affected by German banks tax fraud practices, and the damage caused to state treasuries could be as high as €55.2 billion ($63.4 billion). Contrived “dual ownership” allowed both parties to claim tax rebates even though both were not entitled to it. With the process having gone undetected for years, billions in tax went uncollected by the German state, mostly in the form of rebates which should never have been paid out at all. Industry experts say the practice went on for decades before it was properly grappled with. The scandal came to light in 2016 when it emerged that several German banks had exploited a legal loophole which allowed two parties simultaneously to claim ownership of the same shares.

Hanno Berger, the central suspect in the investigation, now lives in exile in the Swiss Alps. He advised the Australian bank Macquarie, another caught up in the scandal, on cum-ex trading but claims he was not paid for it. He says the scheme was based on a legitimate legal loophole. “They (the German state) cannot punish others for their mistakes,” he said.