Trump’s Truth Social –>Digital World

25 April, 2024

Donald Trump this week received around 36 million more shares in the parent company of Truth Social, thanks to a generous earnout provision.

By the numbers: That gives him around 115 million total shares, or a 65% ownership stake, which were valued at $4.1 billion as of Wednesday’s market close.

[April 18 2024 ]

In a letter to the exchange, Devin Nunes, the CEO of Trump Media (DJT), laid out what he believes could be deemed “naked” short selling.

Naked short selling involves someone selling shares they don’t own or have not borrowed. They will often then try to buy shares at a reduced price to cover themselves. This practice is generally illegal. Whereas legitimate short sellers, people who seek to benefit from declines in the value of a company’s shares, borrow the shares before selling.

[April 18 2024 ]1

Trump Media & Technology Group Corp

4.54 billion USD

Market capitalization Apr 18, 4:07 PM EDT

33.19 USD

+6.79 (25.72%)today

Closed: Apr 18, 4:07 PM EDT

[

26.40 USD

+3.56 (15.59%)today

Closed: Apr 17, 4:06 PM EDT

22.84 USD

−3.77 (14.17%)today

Closed: Apr 16, 4:00 PM EDT •

23.63 down-2.98 (-11.22%)

24.67 USD

- 1.94 -7.29% Today

Current price · 9:57 AM ET · Apr 16, 2024

26.61 USD

−5.98 (18.35%)today

Closed: Apr 15, 4:17 PM EDT •

[April 13 2024 Trump’s Truth Social –>Digital World: Donald @ $6 billion? More? Less? ]

Market capitalization

4.46 billion USD

Closed: Apr 12, 7:58 PM EDT •

Donald Trump’s personal stake at Monday’s close was worth $2.93 billion, down $3.32 billion from the initial pop.

Market Summary

$32.49

-0.10 -0.31%

After Hours Volume: 43.8K

32.41 USD

−1.85 (5.40%)today

Closed: Apr 11, 4:11 PM EDT

32.66 USD

−1.60 (4.67%)today

Apr 11, 11:08 AM EDT

34.26 USD

−3.21 (8.57%)today

Closed: Apr 10, 4:07 PM EDT

37.47 USD

+0.30 (0.81%)today

Closed: Apr 9, 5:42 PM EDT

36.65 USD

−0.52 (1.40%)today

Apr 9, 10:29 AM EDT

37.17 USD

−3.42 (8.43%)today

Closed: Apr 8, 4:07 PM EDT

5.08 billion USD

40.59 USD

−5.56 (12.05%)today

Closed: Apr 5, 4:39 PM EDT

5.55 billion USD Market capitalization

46.15 USD

−2.66 (5.45%)today

Closed: Apr 4, 4:41 PM EDT

50.30 USD

−1.29 (2.51%)today

Apr 3, 11:13 AM EDT •

51.60 USD

+2.94 (6.04%)today

Closed: Apr 2, 7:58 PM EDT

52.64 USD

+3.98 (8.18%)today

Apr 2, 2:01 PM EDT •

48.66 USD

−13.30 (21.47%)today

Closed: Apr 1, 5:19 PM EDT •

After hours 47.50 −1.16 (2.38%) 6.59 billion USD Market capitalization

[10:04 edt ]

Despite that plunge, the company’s market capitalization was still more than $7 billion

Trump Media & Technology Group Corp

[March 28 2024]

53.18 USD

−8.78 (14.17%)today

Apr 1, 11:00 AM EDT •

[March 27 2024 ]

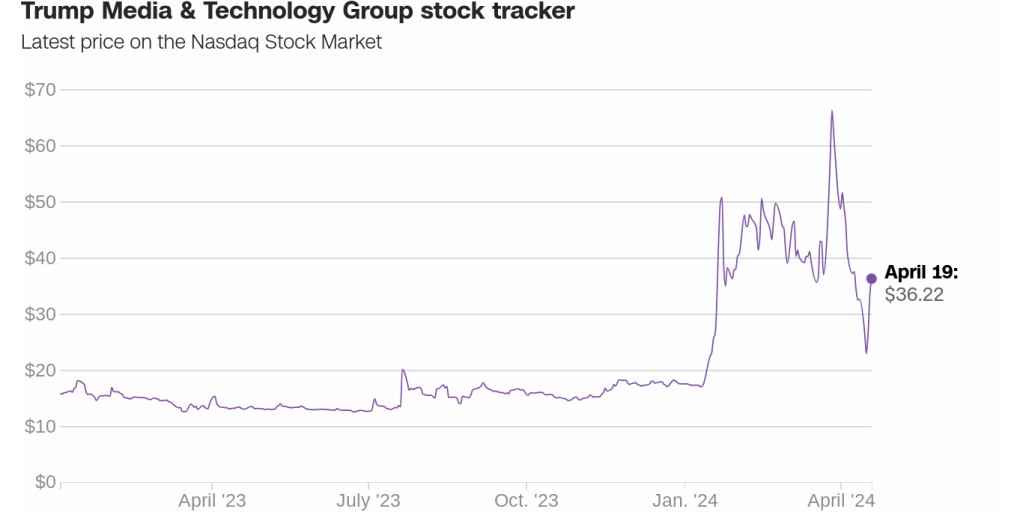

Trump Media & Technology Group (DJT) soared 14% on Wednesday in its second day of trading on the Nasdaq (^IXIC).and climbed 16% in its first official trading day on Tuesday.

[March 26 2024 ]

The former president’s net worth, at least on paper, is now at over $6 billion

Trump Media was valued at over $9 billion at one point though it fluctuated depending on the share price which continued to experience heavy trading.

[10:38 am edt Trump Media @ $9b? ]

[March 25 2024 Trump Media to be publicly traded Tuesday ]

There’s no guarantee the newly merged company will continue to trade at the same price as DWAC. Companies can sometimes trade lower in the months after a SPAC merger, as some early investors sell their stock, Marvin noted.

“You have a washing out of the original shareholders,” she said.

[March 25 2024 ]

Shares in the newly combined company, Trump Media, could begin to be publicly traded this week, and Trump would have nearly 80 million shares, estimated to be worth around $3 billion.

Under the terms of the merger, Trump is prohibited from selling shares in the merged company for at least six months, but the board of directors, which will likely include his eldest son, Donald Trump Jr., could vote to allow him to sell shares earlier than that.

[March 22 2024 investors in acquisition company approve ]

March 22 (Reuters) – Former U.S. President Donald Trump came a step closer on Friday to reaping a major windfall from his social media firm after investors in a blank-check acquisition company approved a tie-up currently worth about $5 billion.

The deal values Trump’s majority stake in the company that holds his app Truth Social at about $3 billion. Digital World’s shares have swung wildly, and there is no certainty they will continue to trade at these levels. The windfall could prove vital as Trump grapples with the financial fallout of a string of legal cases against him, including a $454 million judgment in a civil fraud case in New York.

[March 1 2024 co-founders sue saying they are cut out ]

The lawsuit was filed in Delaware Court of Chancery and alleged that Mr Trump’s media company recently attempted to dilute the share of Trump Media and Technology Group co-founders. The lawsuit alleges that when Andy Litinsky and Wes Moss pitched the idea to the former president they agreed he would receive 90 per cent of the company’s stake and the pair and an attorney on the deal would split the remaining 10 per cent stake, instead of receiving “fee or payment for (their) work” in starting the company.

“The attempt here is to deprive them of the deal,” Christopher Clark, the lawyer for UAV in the partnership’s Delaware lawsuit against TMTG said.

[January 23 2024 –>only direct-ish way to play Trump ]

Digital World’s share price spiked 88% to 19-month highs on Monday alone. That was the day after Florida Governor Ron DeSantis ended his 2024 presidential campaign and endorsed Trump.

The Trump-linked stock tumbled 10% Tuesday morning as residents of New Hampshire began voting in the primary there. But by late afternoon trading the stock reversed course and was up 6% on the day.

Since Trump’s landslide victory in the Iowa caucuses on January 15, Digital World shares have more than tripled.

“After Iowa, it got crazy. This is the only direct-ish way to play Trump,” said Matthew Tuttle, CEO of Tuttle Capital Management.

[January 22 2024 merger to move ahead ]

Shares of Digital World Acquisition Co. DWAC, 73.54% were up more than 25% in Monday morning activity, putting them on track to extend their win streak to a sixth session. The stock is on pace to rise 96% over the six-session run if current gains carry through to the close.

Digital World has filed a third amendment to its Form S-4, lending credence to the thesis that posits the much-delayed merger process continues to move ahead.

DWAC:US

Nasdaq GM (USD)

Delayed price as of

2:02 PM EST 01/22/24

.

Market open.

42.13

+15.75+59.70%

[January 17 2024 SPA/PIPE investments – $1B all gone ]

While PIPE investments worth $467 million had already fled, Digital World intimated in October 2023 that the remaining investments worth around $533 million were also at risk.

Today, as per a pertinent filing with the SEC, Digital World has announced that its Securities Purchase Agreements (SPAs) with the remaining PIPE investors have been “terminated” following the refusal of these investors to entertain any extension or waiver vis-a-vis the contractually mandated closing date:

“As the remaining PIPE Investors were not willing to waive the Effective Registration Closing Condition, on January 10, 2024, the agreement was terminated in full, resulting in the cancellation of the remaining subscription amount of $530,500,000.”

The SPAC continues to retain access to around $293 million in proceeds that it raised as part of its IPO.

Donald Trump’s victory at the Iowa caucuses is lifting shares in the blank-check firm working on taking his media company public.

Digital World Acquisition Corp. rallied 29% on Tuesday, its best day

[November 21 2023 has lost $73m — no,no — $31m!

Truth Social in a new lawsuit filed Monday, said that the reports were actually a vast media conspiracy involving “no less than 20 major media outlets.”

The lawsuit comes following reports this month that Truth had lost $73 million in 2023. That figure turned out to be incorrect; the company has actually lost $31 million.

[November 13 2023 ]

The numbers were revealed in a new financial disclosure from TMTG’s SPAC merger partner Digital World Acquisition Corp. The filing revealed that in 2022, Truth Social lost $50 million on just $1.4 million of net sales, and through the first 6 months of this year it brought in $2.3 million, but lost $23 million.

[October 18 2023 loses its SPAC ]

The company planning to merge with Trump Media & Technology Group, owner of the Truth Social platform, has now walked away from two years of financial statements after informing the Securities and Exchange Commission on Monday that its audited financials for 2021 “should no longer be relied upon.”

[October 12 2023 ]

Digital World Acquisition Corp. (DWAC), a so-called special-purpose acquisition company, said in a regulatory filing that it has received termination notices from investors for $467 million of the funding. The remaining $533 million will be returned to investors, with DWAC CEO Eric Swider saying in a press release that Trump’s media group has a “reduced need for capital” and a “commitment to growing a sustainable business model.”

The loss of funding for DWAC appears to be a step backward for the prospective merger between the company and Trump’s media outfit, Trump Media & Technology Group, which runs Truth Social, a social media service