Russia: London Metal Exchange will no longer accept Russian imports

13 April, 2024

The effect of the amended UK sanctions package is to divide Russian warrants (irrespective of the production date of the Relevant Metal, which in all cases must be before 13 April 2024) into two types:

The LME has issued a market notice imposing an immediate suspension on the warranting of Russian metal produced on or after 13 April 2024. Russian metal warrants issued on or after 13 April 2024 (for metal produced before 13 April 2024), are still subject to restrictions that prevent UK LME Members and Clients from cancelling or withdrawing the corresponding metal unless they are doing so for the account of a non-UK Client. However, all existing Russian warrants (as at the end of 12 April 2024) are now again eligible to be cancelled and withdrawn by UK persons.

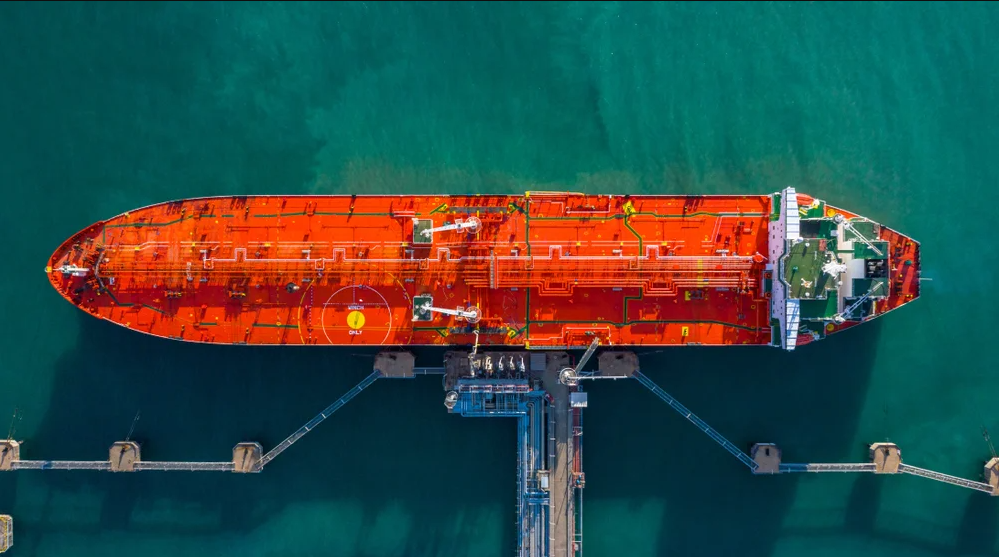

[March 10 2024 Turkey’s Dortyol oil terminal ]

Turkey’s Dortyol oil terminal, managed by Global Terminal Services (GTS), will no longer accept Russian imports amid increased sanctions pressure from the United States, Reuters reported on March 5.

“GTS decided to cut all possible connections to Russian oil and declared accordingly to its customers in late February 2024 that even if there is no breach of any laws, regulations or sanctions, it would not accept any product of Russian origin or any products loaded from Russian ports as an additional measure to the sanction rules in effect,” GTS told Reuters.

[February 5 2024 Russia: few Greek tankers carrying Russian crude ]

The three companies operate more than 100 oil tankers with the capacity to move almost all of the exports from Russia’s European ports of Primorsk, Ust-Luga and Novorossiisk. This amounts to approximately ten million tonnes of oil per month or 2.4 million barrels per day.

Greek-owned ships have disappeared completely from the trade in Russian crude loaded at the country’s Pacific terminals and hauled to buyers in China and India. Russia is now relying on its own shipping company, Sovcomflot, to carry much of its supply. Moscow also works with many smaller companies registered in the UAE, India, Hong Kong, Seychelles, Ghana and other locations, according to traders and shipping data.

[January 27 2024 Russia: Sakhalin oil stranded by sanctions ]

Reuters 27 Jan 2024, 10:50 PM

More than a dozen tankers loaded with 10 million barrels of Russia’s Sokol grade crude oil have been stranded off the coast of South Korea for weeks, so far unsold due to US sanctions and payment issues, according to two traders and shipping data.

The volumes, equating to 1.3 million metric tons, represent more than a month’s production of the Sakhalin-1 project, once a flagship venture of U.S. major Exxon Mobil, which exited Russia after Moscow’s invasion of Ukraine. The Sakhalin-1 oil and gas development project is located off the coast of Sakhalin Island in the Russian Far East. It comprises three offshore fields namely Chayvo, Odoptu, and Arkutun-Dagi.

[October 23 2023 Price Cap sanctions on Russian oil

Suspicions about evasion have grown after analysts noticed that oil from the Russian port of Kozmino on the Pacific Ocean — responsible for a relatively small share of Russia’s exports — was trading well above the cap. That was even though many of the tankers stopping there were Western-owned, primarily Greek.

The price cap is meant to limit what Russia can earn without taking its supplies off the market. Doing that threatens a shortage that could drive up fuel costs and inflation in the U.S. and Europe.

It relies on a key fact of the shipping industry: many vessel owners, traders and most insurers are based in Europe or the Group of Seven major democracies that imposed the price cap. That puts those companies within reach of sanctions.

To comply, shipping companies need to know the price of Russia’s oil. The cap, however, requires only a good-faith disclosure on a simple, one-page document with the names of the parties and the price. The actual sales contracts don’t have to be revealed.

And that, analysts say, has been an invitation for unscrupulous sellers to fudge — and for some shippers to adopt a see-no-evil approach.

Three Greek shipping companies are particularly active in transporting Russian crude, according to the data: TMS Tankers, Kyklades Maritime and Minerva Marine.

TMS is part of Cardiff Marine, which is owned by billionaire George Econonou, while Kyklades is owned by the family of its late founder, Aristides Alafouzos. Minerva is headed by Andreas Martinos, scion of another prominent shipping dynasty.